Introducing Apple Pay Later: Why It Might Be Best to Avoid This New Service

Introducing Apple Pay Later: Why It Might Be Best to Avoid This New Service

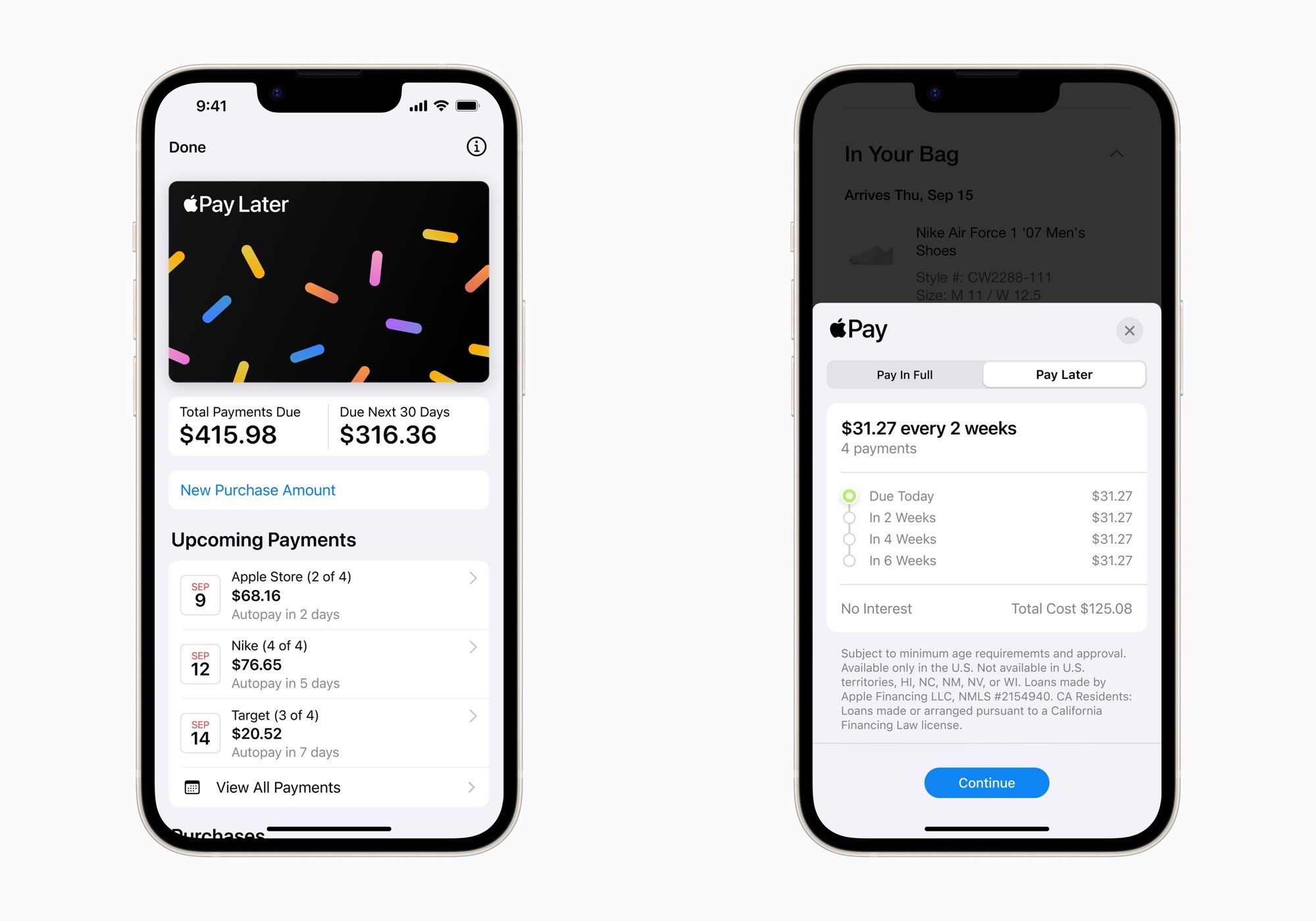

Apple Pay has been around for years as a seamless way to pay for purchases on Apple devices from websites, apps, or physical stores. There’s now a feature for splitting any purchase across multiple payments: Apple Pay Later.

Apple Pay Later is a new feature that allows any purchase made through Apple Pay – not just purchases from Apple – to be split into four payments spread over six weeks. You have to apply for access (which does a “soft pull” on your credit score), with loans ranging from $50 to $1,000, which can then be used towards anything that supports Apple Pay. It works on iPhones with iOS 16.4 or iPads with iPadOS 16.4, and both of those updates started rolling out yesterday .

The service is being run by Apple Financing, a subsidiary of Apple, with the actual purchases running through the Mastercard Installments program operated by Goldman Sachs. Apple says “users’ transaction and loan history are never shared or sold to third parties for marketing or advertising,” but Apple Financing will start reporting loans to U.S. credit bureaus starting this fall, so they will be reflected in the financial information that keep getting hacked . Apple didn’t mention how late fees work.

You should be extremely careful when using Apple Pay Later, Zip payments in Microsoft Edge , and similar “buy now, pay later” (BNPL) services. They are designed to incentivize purchases that you cannot normally afford, and managing payment schedules for multiple purchases on top of your normal bills can be difficult. A survey by DebtHammer in 2022 reported that 22% of people who made purchases with BNPL services later regrated the decision, and 30% said they had to skip other bills to make the payments. CreditKarma conducted a similar survey in 2021 , reporting that 34% of the surveyed group fell behind on one or more payments, and 72% of that group believe that it negatively affected their credit score.

Even though they may seem useful, and a little bit tempting, it’s usually best to avoid services like Apple Pay Later entirely. It’s hard enough to stay on top of finances, and adding more debt only makes it harder.

Source: Apple

Also read:

- [New] 2024 Approved Streamlining Communication Scheduling Monthly Meets

- [Updated] Expert Recommendations High-End Ringtone Fabricators

- [Updated] In 2024, VLLEvaluation Insight Into App Quality

- 2024 Approved Experience the Future with These Top iPhone VR Titles

- 2024 Approved Expert Tips for Optimizing Your SRT Setup

- 2024 Approved Hear the Game of Thrones in Your Phone - Top Sites Listed

- 2024 Approved How to Save Top Cloud Providers' Rates

- 2024 Approved How to Zoom In Google Meet

- 2024 Approved Innovation in Minimization The Finest Selection of 43 Mobile Video Trimming Apps

- Authentication Error Occurred on Xiaomi Redmi Note 12 Pro 4G? Here Are 10 Proven Fixes | Dr.fone

- Easy Steps to Transform iPhone 7 Into a Recorder

- Expertly Selected 6 Premier Tools to Refine Your Images Online for 2024

- Flight in the Smallest Form A Compreenasive Look at DJI Spark's Miniature Wonders for 2024

- From Idea to GIF Your Ultimate Blueprint for 2024

- How to Reset a Samsung Galaxy A25 5G Phone That Is Locked | Dr.fone

- In 2024, How to Unlock a Network Locked Motorola Moto G23 Phone?

- In 2024, Masterful Guide to Professional Online Etiquette on YouTube

- Simple Solutions to Fix Android SystemUI Has Stopped Error For OnePlus 12R | Dr.fone

- Top 4 Artificial Intelligence Strategies to Boost Academic Study

- Title: Introducing Apple Pay Later: Why It Might Be Best to Avoid This New Service

- Author: Frank

- Created at : 2025-02-16 18:39:04

- Updated at : 2025-02-19 18:24:49

- Link: https://some-techniques.techidaily.com/introducing-apple-pay-later-why-it-might-be-best-to-avoid-this-new-service/

- License: This work is licensed under CC BY-NC-SA 4.0.